The first full week of 2021 is coming to an end with plenty of fanfare for the crypto space. Take a moment to catch up on what happened.

January 10, 2021

by CryptoEvents

Bitcoin Surpasses $41,000, Altcoins Spring to New Highs

The leading cryptocurrency has embarked on an unprecedented bull run, having already risen by over 30 percent since the start of 2021. A volatile performance in both markets and politics saw Bitcoin price increasing by almost $8,000 after the attack on the U.S. Capitol on Wednesday, reaching another ATH at levels over $41,500 by Friday.

For the next few days the largest cryptocurrency by market cap has been trading around $40,500, however, by the time of writing the price crashed below $38,000.

Ethereum, the second largest cryptocurrency, surged above 70% after the new year, almost reaching its all-time-high on Sunday. By 10:00 UTC, ETH was trading close to $1,350, but the subsequent correction took the price of the asset down to $1,280.

However, if you measure the price in BTC rather than in depreciating USD or any other fiat currency, the picture is not that bright at all: on June 17, 2017 ETH was changing hands at 0.143 BTC compared to 0.03278 BTC as of today.

Here’s a good thread that covers this often overlooked aspect:

A quick thread on Ethereum for anybody that’s new here.

ETH is currently nowhere near the ATH, and is still down 81.6% from the weekly ETH/BTC ATH. Additionally, the ETH/BTC price has never closed above the 200 week EMA, and is currently crashing below the 50 & 100 EMA’s. pic.twitter.com/80NrCSM8dx

— Stein (@Stein___) December 27, 2020

Anyway, the rest of the market has also been performing well recently. The global crypto market cap surpassed $1 trillion for the first time earlier this week thanks to the success of Bitcoin, and some altcoins also rising sharply. Those include the likes of Stellar’s XLM (+130% over the past 7 days), Cardano’s ADA (+74.5%), Bitcoin Cash (+59.6%), and Ripple’s XRP (+46.4%).

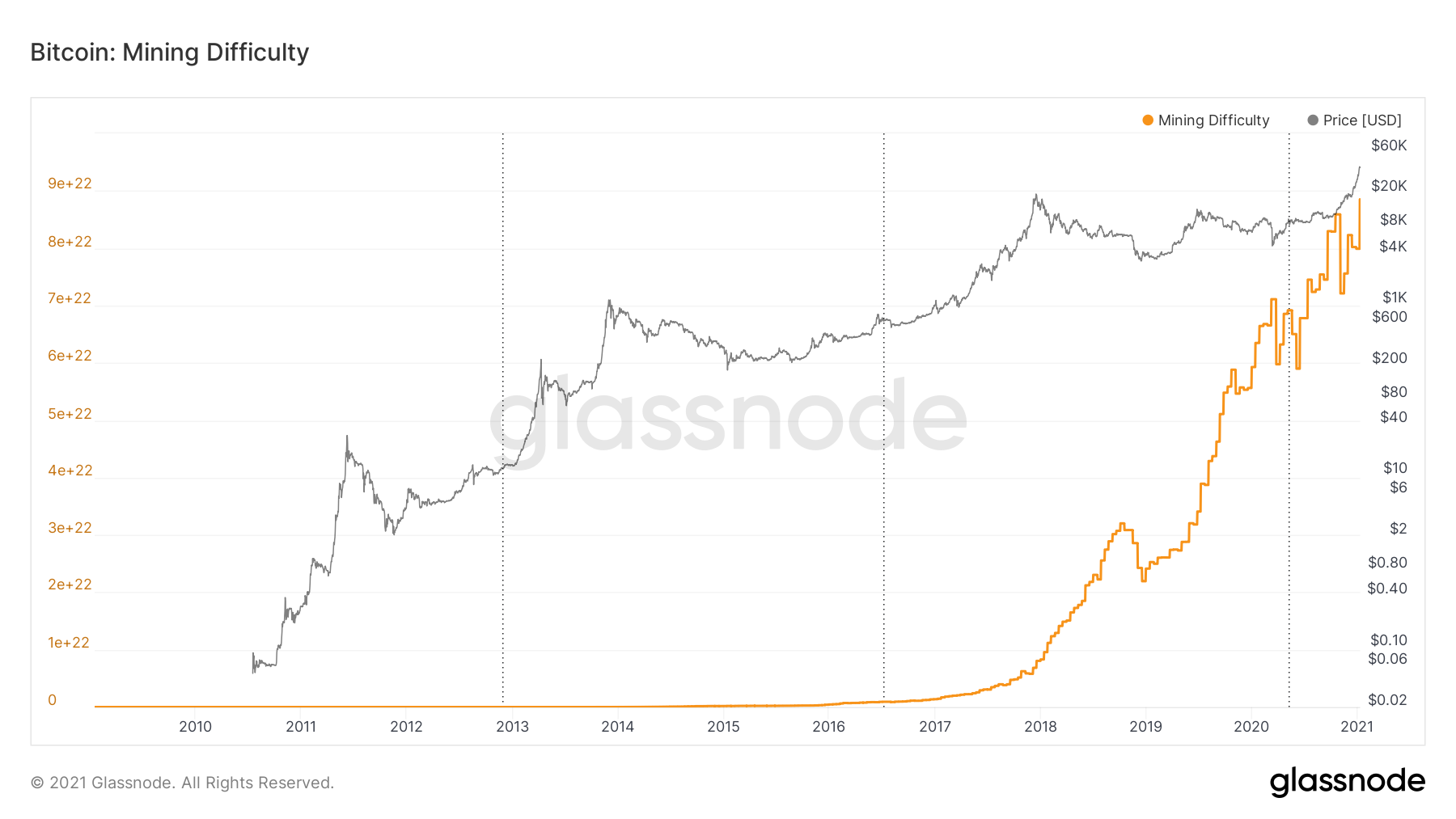

Bitcoin Mining Difficulty Hits Record High

Bitcoin’s mining difficulty reached a record high above 20.6 trillion on Saturday, marking the biggest increase in nearly four months.

Difficulty is a relative measure of the amount of resources required to mine Bitcoin that goes up or down depending on the amount of computing power consumed by the network, known as its hashrate.

Difficulty is a relative measure of the amount of resources required to mine Bitcoin that goes up or down depending on the amount of computing power consumed by the network, known as its hashrate.

As Bitcoin’s price continues to soar, miner revenues keep pace, incentivizing even more participants to mine. Twelve months ago, Bitcoin’s difficulty was below 15 trillion.

Since the halving in May, the total outflows of BTC from miners have been gradually decreasing on average — the opposite of BTC/USD. Hence, miners are still showing no signs of major selling despite the price of Bitcoin skyrocketing to over $41,000 in the past week.

Three Arrows Reports More Than $1.2 Billion Position in Grayscale’s GBTC

Three Arrows Capital has disclosed a more than $1 billion position in Grayscale’s Bitcoin Trust in a new filing submitted to the U.S. Securities and Exchange Commission. According to the Singapore investment firm, the position is the largest in GBTC.

The move follows a similarly large position in the trust placed earlier this year to capitalize on the premium at which it trades relative to Bitcoin. Previously, Three Arrows held 6.26% of GBTC shares, worth $259 million.

According to the most recent filing, the firm’s position represents $1.24 billion. Three Arrows’ current position represents 36,969 BTC, or 6.1% of GBTC’s holdings.

As of January 8, Grayscale managed over $28 billion in assets, up from $2 billion a year ago.

01/08/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $28.4 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/Q0PPbXrnKS

— Grayscale (@Grayscale) January 8, 2021

Also read:

- Grayscale removes XRP from its Digital Large Cap Fund

- Grayscale Investments Names Michael Sonnenshein Chief Executive Officer

ShapeShift Integrates Decentralized Exchanges, Removes KYC Requirements

In order to better protect users while increasing transparency in the digital asset economy, ShapeShift, an international, non-custodial cryptocurrency leader, announced it has integrated decentralized exchange protocols into its platform.

From now on. ShapeShift’s customers will be able to trade directly with these external protocols, rather than trading with ShapeShift as an intermediary, for an easy and seamless user experience.

This change means that ShapeShift customers will no longer need to provide personally identifiable documentation to meet “Know Your Customer” (KYC) regulatory requirements for trading, giving customers greater privacy, security and transparency over their order flow.

According to the company, it also enables ShapeShift customers to access deep digital asset liquidity across more than a thousand new assets and through multiple decentralized exchanges for superior pricing. Because ShapeShift is no longer acting as any form of financial intermediary or counterparty, this new, frictionless UX frees users from having to provide personal, private information.

“Centralized exchanges are black boxes: there is no way to audit them from the outside. You have to trust the operators of that exchange and any other party that can access that data, and that trust is often breached,” said Voorhees, CEO of ShapeShift.“Our goal is to protect people and bring transparency to the financial system. This is open-source finance.”

Block.one CTO Daniel Larimer announces resignation

Daniel Larimer, the CTO of Block.one, announced his resignation on Sunday. In a blog post, Larimer said that he resigned from the project at the end of last year, noting that “all good things must come to an end.”

Block.one, the firm behind the EOS blockchain, raised $4 billion to build out a rival to Ethereum. Larimer has been with the company since April 2017.

“I will continue on my mission to create free market, voluntary solutions for securing life, liberty, property, and justice for all,” Larimer wrote. “I do not know exactly what is next, but I am leaning toward building more censorship resistant technologies.”

Still, Larimer said that he will turn his attention to creating tools that allow people to “secure their own freedom.”

In a previous blog post, the technologist said that he would boycott Twitter because he felt that its censorship “has gotten out of control.” The social media site suspended President Donald Trump’s account following an insurrection on Capitol Hill that many believe the president instigated.

Ripio Acqires BitcoinTrade

Digital asset services firm Ripio said Tuesday that it acquired BitcoinTrade, Brazil’s second-largest crypto exchange, for an undisclosed amount. Ripio plans to bolster its presence in Brazil and across Latin America with the move.

“We’re very excited and confident that Ripio is the best choice to help extend the path we’ve built with BitcoinTrade in Brazil,” said BitcoinTrade founder Carlos Andre Montenegro in a press statement. Montenegro will exit his role as CEO but remain at Ripio, with BitTrade CFO Bernardo Teixeira taking over as chief executive.

Ripio (formerly called BitPagos) ended 2020 on a high, crossing the 1 million user milestone. Earlier last year, the firm began looking in earnest for a good fit in Brazil and decided on BitcoinTrade, said Ripio CEO and co-founder Sebastian Serrano.

Brazil has the largest GDP in Latin America and seems to be a highly desirable virgin territory among South American and Central American crypto exchanges. Last month, Mexico City-based crypto exchange Bitso raised a $62 million funding round, a chunk of which was earmarked for a Brazil push, the company said.

“We have a very good relationship with Bitso,” said Serrano. “Bitso and ourselves are the two really well-funded companies with access to venture capital. There are no companies in that position in Brazil. But really I think the opportunity is about growing the entire Latin America market.”

Ukraine Signs Agreement with Stellar Foundation to Work on Digital Asset Strategy

Ukraine’s Ministry of Digital Transformation has signed a memorandum of understanding with the Stellar Development Foundation, with the two sides agreeing to cooperate on a number of digital asset-related initiatives.

According to statements published Monday, such projects will include assisting Ukraine’s central bank on its digital currency efforts and, more broadly, “the development of a strategy for virtual assets in Ukraine.”

Additionally, the memorandum outlines the core focus on:

- provision of support to projects related to virtual assets;

- implementation and regulation of stablecoin circulation in Ukraine; and,

- facilitation of the development of the digital currency of the Central Bank in Ukraine.

Other Picked Highlights

- CoinDesk Acquires TradeBlock, the World’s Leading Crypto Index Provider

- Blockstream Launches Jade, an Open-Source Hardware Wallet for Bitcoin and Liquid Assets

- South Korean Gaming Giant Nexon to Acquire Bithumb in a $460 Million Deal

- BitMEX Says All Users Are Now Verified

- TaxBit Secures Investments from PayPal Ventures and Coinbase Ventures

- Coinbase Acquires Crypto Trade Execution Startup Routefire

- Bakkt Nears Merger With Victory Park SPAC

- SoFi to Go Public Through Merger with Palihapitiya-backed SPAC

- Square Crypto Funds Bitcoin Developer to Improve Mining Pool Software

- Flare Networks To Airdrop Litecoin HODLers Free Crypto

- BTSE Brings DeFi to Monero

- UK Exchange CoinCorner Adds Lightning Network Support

NOW LIVE ⚡️#Bitcoin #LightningNetwork pic.twitter.com/5UAX7YAFsX

— CoinCorner (@CoinCorner) January 5, 2021