New York, January 5, 2021 — CoinDesk, the global leader in crypto and blockchain news, events, data and research, today announced it has acquired TradeBlock, the world’s foremost provider of digital asset reference rates.

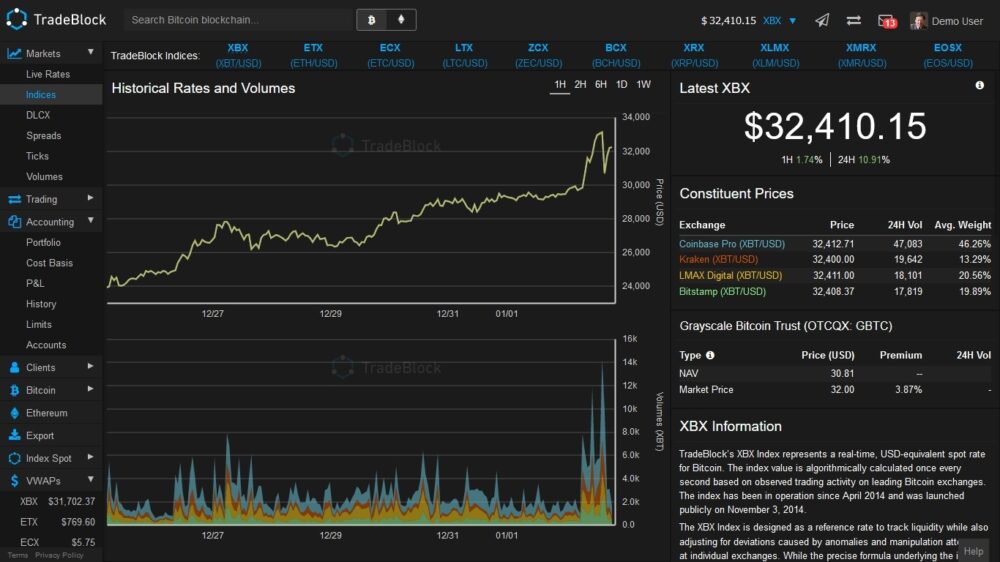

With this acquisition, CoinDesk is positioned to be the leading source of crypto news, information and data for the financial industry. Currently, more than $20 billion of investment products use TradeBlock indexes, and billions of dollars in monthly trading volume is quoted against them.

“Mainstream acceptance of bitcoin is accelerating right now as Wall Street wakes up to its potential. With that has come an urgent need for the kind of robust data and professional tools that enable institutions to participate,” said Kevin Worth, CEO of CoinDesk.

“CoinDesk is now uniquely positioned to provide that service, which will not only benefit those institutions but will also improve information integrity for the retail and other investor segments already engaged in crypto markets,” Worth added.

“We are combining the network effect of CoinDesk’s growing global audience and its reputation as the preeminent crypto and blockchain media company with TradeBlock’s world-class prices, indexes and trading tools. Now we can bring trusted, reliable data and information to this booming market. Much like the role Bloomberg plays in traditional markets, we will be crypto investors’ go-to destination for unified media, events, research, pricing and data.“

CoinDesk digital asset prices and news are already the daily source of truth for millions of crypto users and investors, cited by mainstream media outlets such as The Wall Street Journal, The Financial Times, Axios, CNBC and The New York Times. TradeBlock, meanwhile, has built the industry standard for institutional-grade digital currency price references.

This acquisition takes that to a new level, bringing institutional-grade digital asset pricing to that same mass audience. The combined expertise, vision and brand value will serve as the platform for future index and data products from CoinDesk.

“We’re thrilled to become part of the CoinDesk family, as both firms share a focus on helping clients access institutional-grade infrastructure and information in the cryptocurrency market,” said TradeBlock CEO Nitai Bran. “We are looking forward to the immediate opportunities ahead and to the combined value from two of the longest-standing firms in the industry that will allow us to offer an end-to-end solution to the institutional investor.”

Worth added, “TradeBlock has already set the industry standard for institutional investors as the largest publicly traded cryptocurrency financial product, Grayscale Bitcoin Trust (symbol: GBTC), uses TradeBlock’s bitcoin XBX Index.”

CoinDesk will invest in the index and data business and in TradeBlock’s order management platform and enterprise trading tools, building for the long-term to serve TradeBlock’s growing list of institutional clients. Thus, CoinDesk will be providing the professional investment community with a full, high-performance suite of secure data, trading tools and workflow systems.

At the same time, it will continue to invest in expanding its mass global audience for news and events, as well as TradeBlock’s institutional-grade data and reference rates.

With the acquisition, TradeBlock becomes a wholly owned subsidiary of CoinDesk that will operate completely independently of the media operation. This will allow both firms to maintain TradeBlock’s existing commitment to data security and confidentiality for its clients and to safeguard the integrity of CoinDesk’s journalism in keeping with our independence guidelines. The entire TradeBlock team will stay with the company in the acquisition.

CoinDesk’s parent company, Digital Currency Group, was a minority shareholder in TradeBlock prior to the deal. Grayscale Investments, which manages the Grayscale Bitcoin Trust, is a wholly owned subsidiary of DCG.