Our weekly news digest is back! Take a moment to catch up on what happened this week in the crypto space.

July 4, 2021

by CryptoEvents

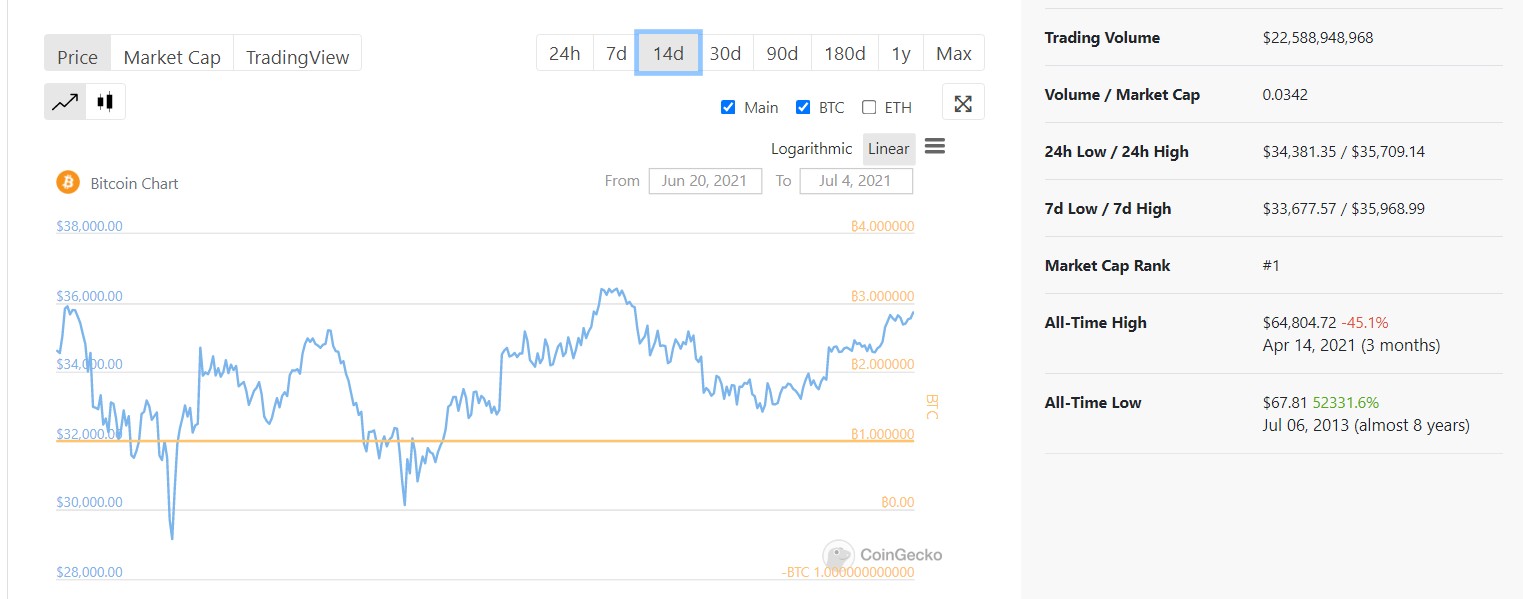

Bitcoin Back Above $35,000

Bitcoin price is up 11% over the past week, having surpassed the $35,000 level on Sunday. The benchmark cryptocurrency surged by more than $3,000 over the past two days, setting its sights on recovering from its worst Q2 performance since 2018.

The price of Bitcoin opened Q2 at $58,800, falling to as low as $29,154 on June 22. According to data from Skew, Bitcoin’s return for Q2 2021 sits at -40%, plummeting from 102% for the previous quarter.

Since 2014, when the flagship cryptocurrency registered a Q2 return of 33.95%, it has never recorded a Q2 return lower than -6%. In fact, Q2 has traditionally been a positive quarter for Bitcoin, with the cryptocurrency registering a positive return on six out of eight occasions since 2014.

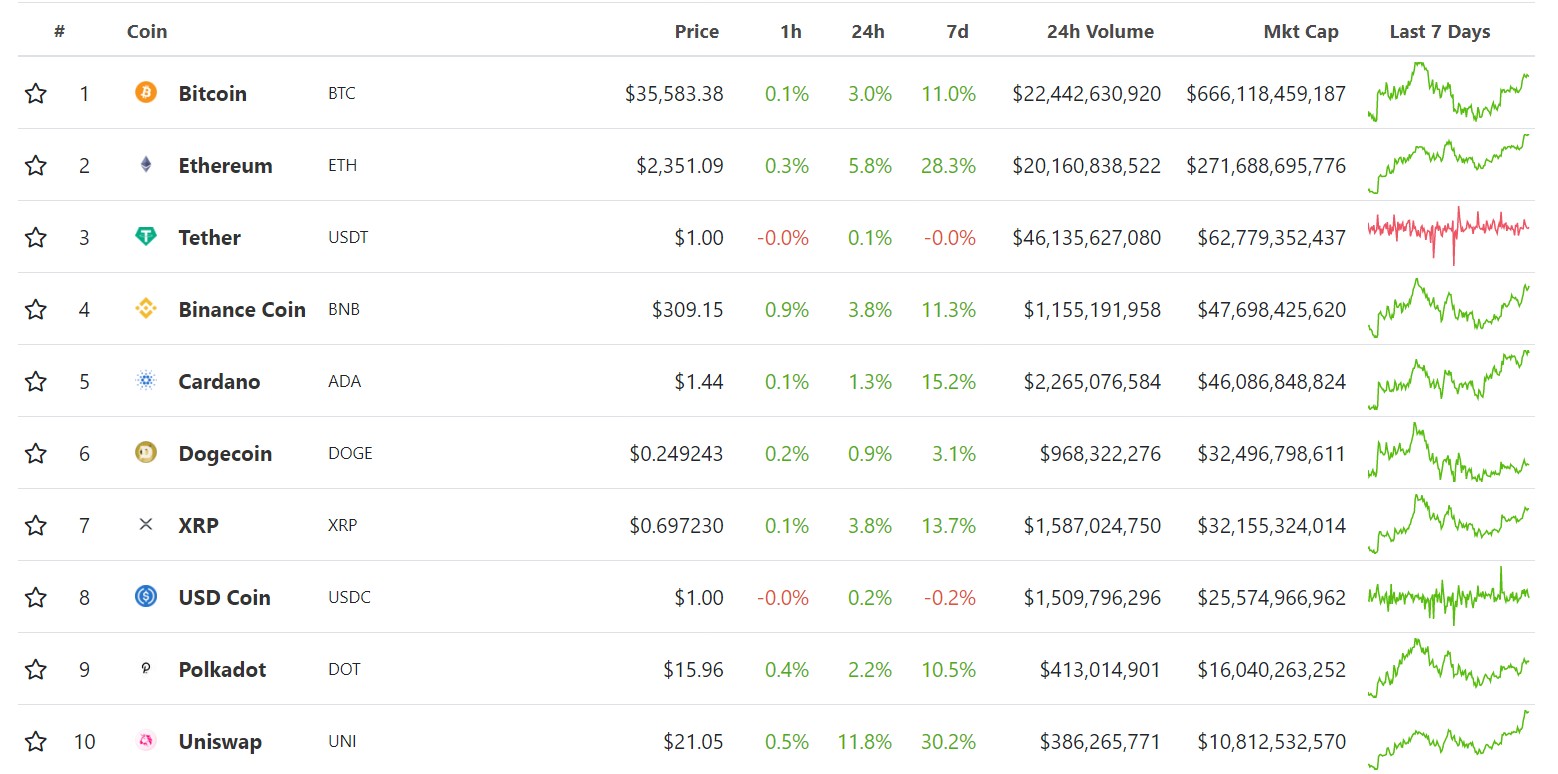

The overall crypto market is in bullish mood as well, with Ethereum, the second largest cryptocurrency by market cap, up by almost 30% over the past seven days. At press time, ETH is changing hands around $2,350.

Among other top gainers are UNI, the governance token for Uniswap decentralized exchange (+30%), as well as Ethereum Classic – the 16th largest cryptocurrency has skyrocketed to a 4-week high above $58, or by almost 50%.

Source: CoinGecko.

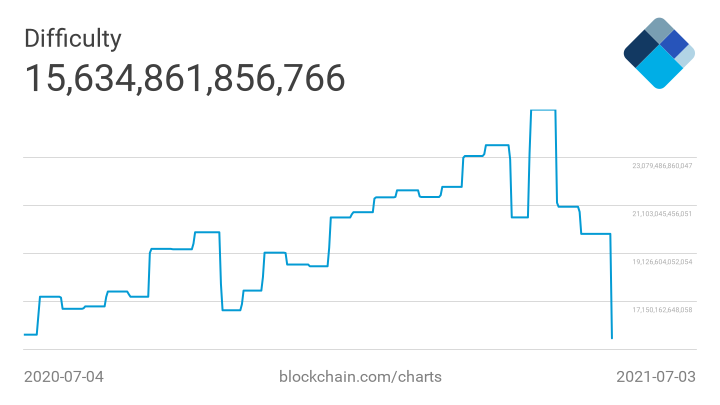

Bitcoin Mining Difficulty Records Biggest Drop in History

Bitcoin mining difficulty has taken the single largest plunge in history – at 6:25 UTC Saturday, at block 689,471, the value fell by nearly 28%.

The adjustment marks the third straight decline in mining difficulty, the first time such a trend has happened since December 2018. On May 29 and June 13, the mining difficulty dropped by 16% and 5%, respectively.

Source: Blockchain.com

Source: Blockchain.com

The latest difficulty mining drop follows China’s crackdown on Bitcoin miners, which were responsible for an estimated 65% of the network’s hash rate. Chinese miners are now emigrating en masse or selling mining machines to foreign mining farms. But until China’s Bitcoin miners find new homes, non-Chinese miners stand to benefit from the reduced difficulty, which makes it cheaper and easier to mine Bitcoin.

ARK Invest Joins the Bitcoin ETF Race

ARK Invest, the investment management firm helmed by Cathie Wood, has filed for a Bitcoin ETF.

According to an SEC filing on Monday, Wood has teamed up with Swiss-based 21Shares AG to offer the ARK 21Shares Bitcoin ETF, which would trade under the ticker symbol ARKB, if approved. The Bitcoin ETF would list on the Cboe Global Markets (CBOE) and would use the S&P Bitcoin Index as its benchmark.

Wood’s prospectus is a part of a growing list of ETF providers and fund managers who are seeking to offer crypto in an ETF wrapper to the masses. The SEC is currently reviewing Bitcoin ETF filings from Kryptoin, WisdomTree, Fidelity, VanEck, and Anthony Scaramucci’s Skybridge Capital; WisdomTree and VanEck have also filed for Ethereum ETFs.

Strike to Offer ‘No Fee’ Bitcoin Purchases

Payments platform Strike will allow U.S. customers to buy and sell Bitcoin with almost no trading fees from today. According to Strike founder and CEO Jack Mallers, platform will be the “cheapest and easiest place on the planet to acquire BTC.”

Per the announcement, Strike has launched the “Bitcoin Tab” enabling the ability to buy Bitcoin with “no fee outside of the market spread.” The Chicago-based payments firm stated that it would charge a maximum “execution cost” of around 0.3% for brokering BTC trades, looking to drop that to below 0.1% over the coming months as volume grows.

The move puts Strike in direct competition not only with Coinbase, but also with the likes of Jack Dorsey’s Square and with PayPal, which started offering crypto assets within the platform to U.S. customers in November 2020.

CoinMarketCap Launches Ethereum Token Swaps Powered by Uniswap

CoinMarketCap (CMC) has launched a token swap feature on its website through an integration with decentralized exchange Uniswap.

CoinMarketCap Launches Token Swaps ? ? #CoinMarketCap #Crypto #Cryptocurrency #Bitcoin #Altcoin #DeFi #Dogecoin #Ethereum #Shibhttps://t.co/52oFJwLe4b pic.twitter.com/ObUNmK5Tpi

— CoinMarketCap (@CoinMarketCap) June 29, 2021

The crypto market data aggregator’s pages dedicated to Ethereum-based token now include a swap icon, enabling users to connect a wallet and swap between ERC-20 tokens. The platform supports wallets from MetaMask, Coinbase, Fortmatic, Portis, and WalletConnect.

CMC also hinted there may be additional integrations with other DEXs and networks in the future, with the announcement noting that only Ethereum is supported “at this time” and Uniswap V1 and V2 will be the “first supported DEX for token swaps.”

JP Morgan Bets on Ethereum 2.0

Ethereum upgrades could jumpstart a $40 billion staking industry, according to a JP Morgan report. The investment bank estimates that the staking industry is currently worth $9 billion and that this number could soar to $40 billion by 2025.

“We estimate that staking is currently a $9 billion business for the crypto economy, will grow to $20 billion following the Ethereum merge, and could get to $40 billion by 2025 should proof of stake grow to the dominant protocol,” the report read.

According to JP Morgan, cryptocurrency intermediaries like Coinbase will make more money if proof of stake becomes popular. Coinbase, the biggest crypto exchange in the U.S., could make up to $500 million in staking revenue by the end of 2025, the report said.

Proof of stake crypto assets, which include Polkadot and Cardano, could also go up in value, JP Morgan added.

“As staking becomes more commonplace, we think it could drive the interest and market capitalization of proof-of-stake cryptocurrencies higher,” the report noted.

Coinbase to Create ‘Crypto App Store’

Coinbase CEO Brian Armstrong has revealed the crypto exchange’s plans to bring decentralized apps to its users through a ‘crypto app store’.

We are embracing decentralization at Coinbase https://t.co/R1Xi3BVniX

— Brian Armstrong (@brian_armstrong) June 29, 2021

“There is now 10s of billions of dollars of economic activity running on dApps, and a new trend coming out every three months,” Armstrong said in a blog on the company’s website. “We’ll work to give our users easy access to all of this from the main Coinbase product.”

In doing so, Coinbase will create a single place where users can turn to get new dApps, as well as access a variety of tools within DeFi, DAOs, smart contracts, NFTs, and more. The company plans to allow third-party developers to publish their applications in the app store, thus allowing easier access to decentralized crypto economy, as the exchange calls it.

Prior to that, Coinbase announced that the U.S.-based retail investors can sign up to receive a 4% return on the USDC stablecoin savings. Due to regulatory restrictions, the offering will not be available for now in New York or Hawaii.

German Investment Funds Are Now Eligible to Invest Into Crypto

A new law in Germany could open up as much as $415 billion in cryptocurrency investments and possibly spurring the country as among the main investment hubs in Europe.

The Fund Location Act, allows special funds or “Spezialfonds” to invest as much as 20% of their portfolio into cryptocurrencies. And should each special fund decide to invest the maximum percentage allowed into digital assets, it would equate to €350 billion ($415 billion), a figure projected by Sven Hildebrandt, CEO of Distributed Ledger Consulting.

“This won’t happen overnight, but we are talking about the largest investment vehicle that we have in Germany—literally all the money is in there,” Hildebrandt told Decrypt.

Robinhood Files to Go Public

Robinhood, the popular online broker, filed paperwork for its hotly anticipated initial public offering. The company intends to raise up to $100 million as part of its IPO process, and will list its shares on the Nasdaq under the ticker symbol HOOD.

The pandemic boom in meme stocks and crypto helped Robinhood pull in $7.5 million in profits on $959 million in revenue for 2020, according to its S-1 filing with the SEC. Much of the company’s recent growth is connected to the rise of Dogecoin.

Robinhood has also made itself a major player in crypto—9.5 million of its users traded crypto on the platform in the first quarter of 2021—and is poised to emerge as a serious rival to Coinbase in the coming years.

Mercado Bitcoin Raises $200M

Mercado Bitcoin, the largest Bitcoin exchange in Brazil, has raised $200 million in a Series B round led by SoftBank Latin America Fund. The round values 2TM Group, Mercado Bitcoin’s non-operating parent company, at $2.1 billion, ranking it among the top 10 unicorns in Latin America.